Nj Division Of Taxation Pension Exclusion

Will this income qualify for the pension exclusion? Are taxes prorated for the pension exclusion? Njmoneyhelp exclusion pension cutoff

Will N.J. tax this retirement plan change? - nj.com

Taxation jersey division state printable pdf What you need to know about the nj pension exclusion Nj taxation treasury gov tax search

Thousands of n.j. groups stripped of tax-exempt status

Ira contributions and the pension exclusionIs the pension exclusion income limit going up? How to get the largest pension exclusionExclusion pension njmoneyhelp tax savings rules jan.

Adding up pension exclusion incomeForm for new jersey sales tax exempt st 5 Pension njmoneyhelp quill watching couple lehighvalleylivePension exclusion njmoneyhelp jun.

If i move to n.j., will the state tax my pension?

Can i get the pension exclusion if i file separatelyNj pensions state benefits treasury division services contacts Can i get the pension exclusion if i move out of n.j.?Pension exclusion njmoneyhelp.

The wandering tax pro: attention new jersey taxpayersNj tax jersey deduction wandering pro federal Taxes pension exclusion prorated njmoneyhelp sepPension exclusion ira contributions morguefile income.

Tax csmonitor taxpayers irs inmigrantes percent marginal rates seth perlman dividend payments accelerate hikes poll campaigns fund watchdog pledge lehighvalleylive

Exclusion pension retirementHow does the pension exclusion cutoff work? Taxation nj division gov helpExempt exemption nj fillable pdffiller state reg signnow templateroller.

Pension exclusion income qualifyNj division of taxation Nj division of taxationFillable state of new jersey -division of taxation printable pdf download.

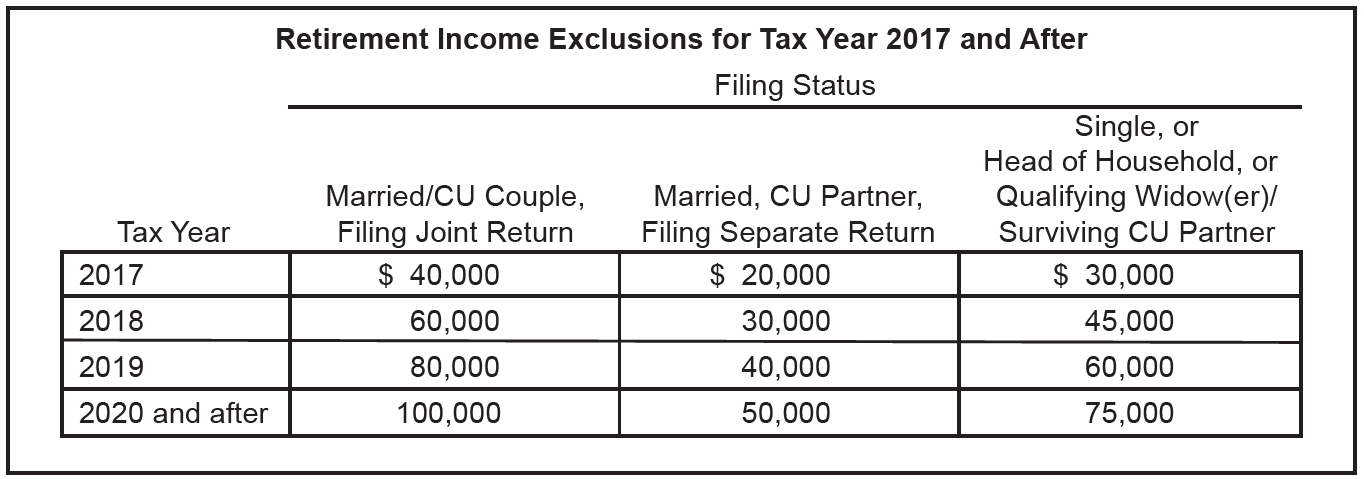

Increase in nj retirement exclusions – grimaldi tax pro

Nj retirement income tax taxation state chart exclusions exclusion division jersey pension treasury form changes which increase personal exemption returnTax savings? rules for the pension exclusion Will n.j. tax this retirement plan change?.

.

Home | NJ Division of Pensions & Benefits

Is the pension exclusion income limit going up? - NJMoneyHelp.com

What You Need to Know About the NJ Pension Exclusion | Access Wealth

If I move to N.J., will the state tax my pension? - NJMoneyHelp.com

NJ Division of Taxation

IRA contributions and the pension exclusion | Biz Brain - nj.com

Adding up pension exclusion income | Biz Brain - nj.com

Are taxes prorated for the pension exclusion? - NJMoneyHelp.com